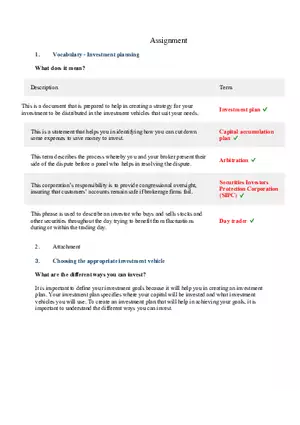

Assignment

Financial Ratio Problem Set

-

University:

California State University, Northridge -

Course:

FIN 303 | Financial Management Academic year:

2015

-

Views:

242

Pages:

2

Author:

Embellobecy8

Report

Tell us what’s wrong with it:

Thanks, got it!

We will moderate it soon!

Report

Tell us what’s wrong with it:

Free up your schedule!

Our EduBirdie Experts Are Here for You 24/7! Just fill out a form and let us know how we can assist you.

Take 5 seconds to unlock

Enter your email below and get instant access to your document