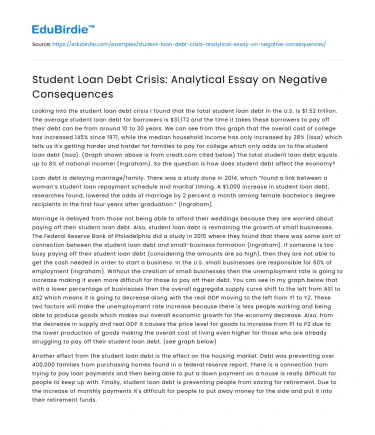

Looking into the student loan debt crisis I found that the total student loan debt in the U.S. is $1.52 trillion. The average student loan debt for borrowers is $31,172 and the time it takes these borrowers to pay off their debt can be from around 10 to 30 years. We can see from this graph that the overall cost of college has increased 145% since 1971, while the median household income has only increased by 28% (Issa) which tells us it's getting harder and harder for families to pay for college which only adds on to the student loan debt (Issa). (Graph shown above is from credit.com cited below) The total student loan debt equals up to 8% of national income! (Ingraham). So the question is how does student debt affect the economy?

Loan debt is delaying marriage/family. There was a study done in 2014, which “found a link between a woman’s student loan repayment schedule and marital timing. A $1,000 increase in student loan debt, researches found, lowered the odds of marriage by 2 percent a month among female bachelor’s degree recipients in the first four years after graduation.” (Ingraham).

Save your time!

We can take care of your essay

- Proper editing and formatting

- Free revision, title page, and bibliography

- Flexible prices and money-back guarantee

Marriage is delayed from those not being able to afford their weddings because they are worried about paying off their student loan debt. Also, student loan debt is restraining the growth of small businesses. The Federal Reserve Bank of Philadelphia did a study in 2015 where they found that there was some sort of connection between the student loan debt and small-business formation (Ingraham). If someone is too busy paying off their student loan debt (considering the amounts are so high), then they are not able to get the cash needed in order to start a business. In the U.S. small businesses are responsible for 60% of employment (Ingraham). Without the creation of small businesses then the unemployment rate is going to increase making it even more difficult for those to pay off their debt. You can see in my graph below that with a lower percentage of businesses then the overall aggregate supply curve shift to the left from AS1 to AS2 which means it is going to decrease along with the real GDP moving to the left from Y1 to Y2. These two factors will make the unemployment rate increase because there is less people working and being able to produce goods which makes our overall economic growth for the economy decrease. Also, from the decrease in supply and real GDP it causes the price level for goods to increase from P1 to P2 due to the lower production of goods making the overall cost of living even higher for those who are already struggling to pay off their student loan debt. (see graph below)

Another effect from the student loan debt is the effect on the housing market. Debt was preventing over 400,000 families from purchasing homes found in a federal reserve report. There is a connection from trying to pay loan payments and then being able to put a down payment on a house is really difficult for people to keep up with. Finally, student loan debt is preventing people from saving for retirement. Due to the increase of monthly payments it's difficult for people to put away money for the side and put it into their retirement funds. People are applying for 401(k)’s but its affecting how much people can actually put into those accounts. Some policies that can be put into place to try and help with the student debt are for one to forgive all federal student loan debt. This would mean that the government will forgive all outstanding federal student loans, the cost of this policy would be close to $1.5 trillion, but the effects would eliminate debt for all 43 million suffering in debt from their student loans (Miller, Campbell, Cohen, Hancock) Another policy could be to forgive a set dollar amount for all students. This policy would forgive the lesser of a borrowers student loan balance/set dollar amount. The dollar amounts would be chosen based on the amount of annual income a person makes every year and they would come to an average dollar amount that would help everyone. The cost for this operation would depend on all the of the dollar level chosen, for example if they chose to forgive $40,000 for all borrowers then it would cancel $901.2 billion (Miller, Campbell, Cohen, Hancock) Depending on the dollar level chosen and all of the money can be lifted and costing borrowers less money (Miller, Campbell, Cohen, Hancock). I find these two policies to be the most beneficial because it would end with all or almost all of the debt being lifted and helping a lot of people who are struggling to pay off their loans. Other policies that can be put into place can be to forgive the debt held by former pell recipients. Pell grant recipients are “college students determined by the federal government to be sufficiently low income to qualify for financial help that doesn't not have to be repaid. In the case of students receiving the maximum award, there is an understanding that their family should not be asked to contribute anything for the price of college.” (American progress). This policy would help cancel all student loans only with those who hold a pell grant. The point behind this would be to consider that those with pell grants were never supposed to borrow because they wouldn’t be able to afford the aftermath.

There is no set cost on how much this policy would be. But, the policy would be beneficial to a lot of people as you can see In the graph below. It shows the share of borrowers who were given a pell grant depending on the year. (graph above from American progress cited below) This figure shows how many grant recipients there are and they cover the cost for half of the population. There isn’t a clear number of how many people this would be help but around 55 to 60% of students receive grants meaning this policy would help greatly (Miller, Campbell, Cohen, Hancock). Finally, the last policy that can be put into place is to reform the IDR and take on the interest growth in order to shorten the amount of time it takes to pay off student debt. Around 12 years ago, congress created a payment plan to help with unaffordable student loans. The plan would be to provide monthly payments to “how much money borrowers earn and provide forgiveness after some set period of time in repayment.” (Miller, Campbell, Cohen, Hancock). This program has become very popular but it does not provide the relief that many people were hoping to get. With the monthly payments piling up and the income not flowing in the interest only keeps going up making them have to pay even more than they did to begin with. The plan with this policy would be to take out the interest portion completely so it would not accumulate on them. Borrowers will start to make monthly payments equal to 10 percent of their income every month. Even though this may take people longer than 10 years it would be more beneficial because they would be making equal monthly payments along with not having the worry of paying off any interest. The plan to forgive all of the interest would benefit a lot of people in paying off their debt. There is no specific cost to how to much it would take to put this in place but it would help over 7.7 million people on the IDR plans. These changes would benefit greatly to those on the plan. These four policies would benefit so many people that are currently trying to pay off their student debt and just by having a little change can change the lives of so many people and help those get married sooner, start businesses, contribute to the housing market and so much more. We want people to attend college and increase their knowledge so when they come into the labor force we can overall increase the economy’s economic growth. If we were to implement any of these policies into place to help with the student debt, then the overall demand for college will increase causing the aggregate demand curve to shift to the right from AD1 to AD2. Increasing the educational labor force will also help shift the aggregate supply curve to the right from AS1 to AS2 causing the real GDP to increase from Y1 to Y2 and the unemployment rate to decrease creating more jobs for those because they are not worrying about paying off their student debt. With GDP increasing and unemployment decreasing this will overall help our economic growth immensely if we were able to help with the student loan debt. (see graph below)

Works Cited:

- Miller, Ben; Campbell, Colleen; Cohen, Brent J.; Hancock, Charlotte et al. 'Addressing The $1.5 Trillion In Federal Student Loan Debt - Center For American Progress'. Center For American Progress, 2019, https://www.americanprogress.org/issues/education-postsecondary/reports/2019/06/12/470893/addressing-1-5-trillion-federal-student-loan-debt/.

- Ingraham, Christopher. '7 Ways $1.6 Trillion In Student Loan Debt Affects The U.S. Economy'. Washington Post, 2019, https://www.washingtonpost.com/business/2019/06/25/heres-what-trillion-student-loan-debt-is-doing-us-economy/. Accessed 12 Dec 2019.

- Issa, Natalie. 'U.S. Average Student Loan Debt Statistics In 2019 | Credit.Com. '' Credit.Com, 2019, https://www.credit.com/personal-finance/average-student-loan-debt/.

- https://www.americanprogress.org/issues/education-postsecondary/reports/2019/06/12/470893/addressing-1-5-trillion-federal-student-loan-debt/

- https://www.americanprogress.org/issues/education-postsecondary/reports/2019/06/12/470893/addressing-1-5-trillion-federal-student-loan-debt/

- https://www.credit.com/personal-finance/average-student-loan-debt/

Stuck on your essay?

Stuck on your essay?