In-time submission and academic quality guaranteed.

Inflation Essays

21 samples in this category

Essay examples

Essay topics

Inflation is the measurement of how much more costly a collection of goods and services has gotten over time, generally a year. It’s possible that it’s one of the most well-known economic terms. Inflation has thrown countries into a state of insecurity for extended periods of time. Many central bankers...

2 Pages

866 Words

“Production is the only answer to inflation”, - Chester Bowles. Inflation is the rate at which the general degree of costs for products and enterprises is rising and, therefore, the buying intensity of money is falling. Inflation has a lot of positive impacts it helps a lot to raise the GDP (Gross domestic product) of the country. Inflation is necessary...

Impact of Inflation on the Economy

1 Page

525 Words

Trending 🔥

Giving people the resources and ability to learn about how things are going in our economy is an extremely important thing. One issue that is especially prevalent in today’s economy is inflation and how it affects the overall well-being of the people in our country and around the globe. This economic issue affects every member of our society, and it...

The Concept of Inflation: Definition, Causes, Types and Fight Against It

3 Pages

1226 Words

Trending 🔥

Have you ever thought about how inflation can affect us in a financial sense? This paper will go in depth and explain the causes of inflation and how it affects consumer behavior, income, investment, and business. In this paper we will go over the methods on how inflation is usually managed and what standards it meets to raise alarm about...

Thinking About Whether Inflation Could Be Good for the Economy

1 Page

442 Words

Let’s first know what’s ‘inflation’; it’s the increase in consumer goods and services price cause of producing several banknotes more than those goods and services itself. Or vice versa, which means there is a production surplus remains from the overall supply, or maybe because of the increase in production cost itself. A lot of causes could lead to inflation. Therefore,...

Essay on Inflation and Its Effects

1 Page

607 Words

While increasing demand is generally great news for an economy, a lagged supply chain can cause Inflation. In this blog post, we'll go through why this is a very real issue facing economic managers all around the world. Firstly, what is inflation? Inflation occurs when the demand for a product/service is greater than the current supply. When this occurs, the...

Link Between Inflation and Unemployment

10 Pages

4520 Words

Today, as thirty and forty years ago, economists debate how much unemployment is voluntary, how much involuntary, how much is a phenomenon of equilibrium, how much a symptom of disequilibrium; how much is compatible with competition, how much is to be blamed on monopolies, labor unions, and restrictive legislation, how much unemployment characterizes ‘full’ employment. A concept of full employment...

Essay on How Inflation Is Affecting America

1 Page

617 Words

This report discussed the path of inflation in the united States of America. The first path of the report discussed the path of inflation. After that, the growth of the economy and the output gap of the USA are discussed in this report. Then, an Evaluation of unemployment in the USA is described in this research. There are different types...

Inflation Issue Essay

1 Page

564 Words

Introduction Inflation, the general increase in prices over time, is a persistent economic issue that affects individuals, businesses, and governments. While moderate inflation can be a sign of a healthy economy, high or unstable inflation rates can have detrimental effects. This essay will present an argumentative analysis of the inflation issue, highlighting the challenges it poses and proposing potential solutions...

Inflation Rate Essay

1 Page

614 Words

Introduction The inflation rate is a key economic indicator that measures the rate at which prices of goods and services in an economy are rising over a specified period. It is a critical component of monetary policy, affecting consumers, businesses, and policymakers alike. This essay aims to provide a critical analysis of the concept of inflation rate, exploring its implications,...

Inflation Argumentative Essay

1 Page

624 Words

Introduction Inflation is a persistent concern in the field of economics and has a profound impact on individuals, businesses, and governments. While some argue that moderate inflation is essential for economic growth, others contend that high inflation erodes purchasing power and undermines economic stability. This essay presents an argumentative analysis of inflation, exploring its causes, consequences, and the need for...

Essay on Inflation and Unemployment

4 Pages

1822 Words

1.1 Executive Summary The main objective of this report is to determine the factors that led to the issue of unemployment and disturbed the economy of Pakistan from 1999 to 2010. Unemployment is a very serious problem that causes the decline in the economic growth of a country and that also affects the international status of that country. To study...

Venezuela and US Inflation Essay

4 Pages

1826 Words

Economic Situation • Foreign trade The United States supplies more than one-third of Venezuela's food imports. Recent government import policies have led to a shortage of goods throughout the country. During the crisis in Bolivarian Venezuela, Maduro decided to purchase hundreds of military vehicles to be used against large waves of protests instead of purchasing goods for Venezuelans, allocating only...

Objective Inflation in Philippines Essay

3 Pages

1382 Words

As obvious as it seems, the world is run by money. Businesses are established to earn money. Roads and other infrastructures were built because of money. People work because of money. This is of course in a metaphorical sense, but one cannot deny the fact that almost everything is valued through money and by money. In this economy, in this...

Money Growth and Inflation Essay

3 Pages

1503 Words

Part I. Considering how the data may be generated using economic theory. The quantity theory of money suggests a relationship (in the long run) between money growth and inflation. Explain the economic intuition behind this relationship. In the long run, The quantity theory of money (M) means an increase in the quantity of money brings an equal percentage rise in...

Inflation and the Federal Reserve Essay

3 Pages

1357 Words

Introduction Inflation and unemployment are two macroeconomic components that affect a country's economy or global economy. This paper addresses these two macroeconomic factors (Inflation and unemployment) and describes a current event related to actions taken by the U.S. Federal Government Reserve Board. The purpose of assessing these two macroeconomic factors is to analyze critically, visualize, and recommend the impacts of...

Grade Inflation Essay

1 Page

400 Words

“Grade Inflation: Causes, Consequences, and Cure,” is an informational article written by a published author, Faieza Chowdhury, who attended Southeast University with a Masters in Science. In “Grade Inflation: Causes, Consequences, and Cure,” Chowdhury explains the meaning and aspects of Grade inflation. Chowdhury uses many other articles and authors' opinions to write her article incorporating her own opinions and thoughts...

Thesis Statement about Inflation

5 Pages

2194 Words

1 Background of the study Macroeconomic stability is a fundamental macroeconomic policy objective of every country, whether developed or developing (Frimpong & Oteng-Abayie, 2010; Agalega & Acheampong, 2013). This has made the study of the relationship between inflation and economic growth of interest to economists for a long period of time (Khan, 2014). The primary objective of such studies has...

Essay on Inflation

3 Pages

1370 Words

Inflation is the measurement of how much more costly a collection of goods and services has gotten over time, generally a year. It's possible that it's one of the most well-known economic terms. Inflation has thrown countries into a state of insecurity for extended periods of time. Many central bankers aim to be dubbed 'inflation hawks.' Politicians have won elections...

Food Insecurity and Inflation: Shortage of Food Supply and Policy Gaps in Pakistan

2 Pages

815 Words

Increase in Food items Prices as per Pakistan Bureau of Statistics: Pulse moong (19.74%), Pulse gram(18.2%), Chicken (17.53%), Eggs (14.28%), Wheat(12.63%), Besan(12.09%), Fresh vegetables(11.7%), Pulse mash(10.29%), Gur(9.49%), Beans(8.09%), Wheat flour (7.42%), Pulse masoor(7.33%), Condiments and Spices(7.15%), Gram whole (6.68%), Sugar(5.07%), Fresh fruits(3.93%), Mustard oil(2.87%), Wheat products(2.64%), Vegetable ghee(2.18%), Rice(1.2%), Fish(1.19%) and Dry fruits(1.09%). Decreased: Onions (18.37%), Tomatoes (8.36%) and Potatoes...

Analysis of the Main Economic Indicators of Australia

4 Pages

1988 Words

This report will detail the current trends in three key economic indicators within Australia, and the impacts of these if they are too high, or too low. Economic indicators are a piece of economic data, that is used by analysts to interpret current or future investment possibilities. This report uses three economic indicators: inflation, unemployment and income/wealth distribution. It has...

Threat of Sustained Inflation Growth in the Near Term

2 Pages

857 Words

The COVID-19 pandemic has led to huge social and economic upheaval globally. In March 2020, the US 10-year breakeven rate (the market-implied average inflation rate over the next decade) reached 0.55%, when the world was peering into a deflationary abyss. Fast forward a little over a year, and investors have flipped from fears of persistent deflation, to fears of persistent...

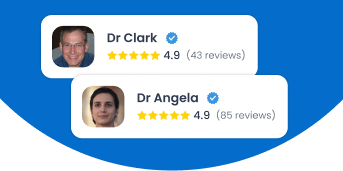

Join our 150k of happy users

- Get original paper written according to your instructions

- Save time for what matters most

Fair Use Policy

EduBirdie considers academic integrity to be the essential part of the learning process and does not support any violation of the academic standards. Should you have any questions regarding our Fair Use Policy or become aware of any violations, please do not hesitate to contact us via support@edubirdie.com.