In-time submission and academic quality guaranteed.

COVID-19 Essays

137 samples in this category

Essay examples

Essay topics

Introduction

Coronavirus is a family of viruses that cause respiratory illness in human beings, corona virus is a zoonotic virus. Covid19 is a disease caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), it is a deadly communicable disease that was initially discovered in china, but later was a world pandemic...

1 Page

633 Words

On 9/11, Americans discovered we are vulnerable to calamities we thought only happened in distant lands. The 2008 financial crisis told us we also can suffer the calamities of past eras, like the economic meltdown of the Great Depression. Now, the 1918 flu pandemic is a sudden specter in our lives. This loss of innocence, is a new way of...

Threat of Coronavirus on Australian Economy

2 Pages

819 Words

Devastating droughts, brazen bushfires and now; contagious COVID-19. Whatever our nation is threatened by next we assure you our government will be ready to act. Currently COVID-19 has infected 90 countries and has been contracted by over 100,000 people. This pandemic is creeping dangerously close to our Australian shores and likely has infiltrated our lands as we speak. Our government...

AustraliaCoronavirus

Impact of Coronavirus on FDI, Trade Policies, and Global Production

2 Pages

1101 Words

The coronavirus has been labelled a global pandemic by the World Health Organisation, due to its effect on society. This has left countries no choice but to implement strict lockdown measures to prevent the spread, which is likely to trigger a global recession, this is primarily due to the sharp rise in unemployment, decrease in demand, and their knock-on effects....

The Masque Of The Red Death And Coronavirus

1 Page

408 Words

As many may know, the Coronavirus outbreak was first recorded in China . Ever since then, the virus has spread all over the world and is now a pandemic. Coronaviruses are a family of viruses that cause illnesses that can range from a common cold to more severe diseases such as Middle East Respiratory Syndrome (MERS) and Severe Acute Respiratory...

CoronavirusThe Masque of The Red Death

Pros and Cons of Coronavirus Essay

3 Pages

1474 Words

In the 21st century, Australian women have continued to fight and gain many fundamental rights in all aspects of life, however, it is not arguable that there is still a long way to go. Since the declaration of pandemic status, the Coronavirus has only intensified the disparity in Australian gender inequality and could threaten this issue in years to come....

Pros and Cons of Online Learning during the Coronavirus Pandemic

2 Pages

1085 Words

The coronavirus pandemic has already ruined many people’s lives, and learning virtually has made it harder for many teachers and students. Although it may be hard for people, there are various pros and cons of online learning and they are covered in the article 'Make Schools More Human' published in the New York Times by Jal Mehta. He starts by...

Pros and Cons of Coronavirus: Critical Essay

3 Pages

1455 Words

COVID-19 has been an unprecedented situation ever happened over the current century. Even though science considers this century as the most powerful of all times, now the whole world is struggling to handle this pandemic case. I agree with the points you have mentioned to some extent and propose some more views in the end. From an economic perspective, the...

Life before and after Coronavirus: Critical Essay

5 Pages

2435 Words

A few months ago, people were presented and or told about a sickness that could be developing in China. With many people traveling to China from the US, this brought up many concerns. People who did travel to China had a very high risk of having coronavirus when they came back to the US and infecting others without even knowing....

Disadvantages of Coronavirus in Our Life: Critical Essay

1 Page

631 Words

Like a light loses its shine, an air that couldn't blow its refreshing air and even plants are about to shrivel. These are the representation of our every life when this pandemic started. Many have lost their job and stopped pursuing their study. Some are losing their hope if ever they could go up on stage to make their parents...

Coronavirus Vaccines: Argumentative Essay

2 Pages

838 Words

Thousands of people around the globe are dying every day due to Covid-19. Superpowers like the United States are seeing their economies shrinking rapidly and whereas a full lockdown is effective, it cannot last forever. We all know that the world can only return to normal if a vaccine is found. World-leading research laboratories are competing with each other to...

Work from Home During the Coronavirus Pandemic: Critical Essay

6 Pages

2654 Words

The business world was catapulted into turbulence and uncertainty in March 2020 when the World Health Organization declared the coronavirus outbreak a pandemic, and companies were forced almost immediately into considering new working methods. This situation allows us to interrogate the future of work in a world changed by the consequences of the coronavirus pandemic. During the critical pandemic, the...

CoronavirusWork

Story of Coronavirus Victim Survivor: Narrative Essay

2 Pages

915 Words

I was one of the luckiest people in the world because I survived this pandemic and it is one of the scariest memories that I will not forget. That’s because even in its initial stage, it is very brutal. In this essay, I want to share my story, the story of a person affected by the coronavirus. I want people...

CoronavirusSurvival

Essay on Coronavirus

3 Pages

1385 Words

Introduction Coronavirus is a family of viruses that cause respiratory illness in human beings, corona virus is a zoonotic virus. Covid19 is a disease caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), it is a deadly communicable disease that was initially discovered in china, but later was a world pandemic (Khan S, 2020). Symptoms of Covid-19 are like those...

Coronavirus

Effect of The Coronavirus Disease on Respiratory System

5 Pages

2130 Words

The Coronavirus Disease 2019 or COVID-19 caused by SARS-CoV-2 is a respiratory illness which has been declared as a pandemic by the World Health Organization in March 2020. Several studies including the 10 articles chosen have found that the virus may impact human organ physiology that may result to death in Covid-19 patients. As the pandemic is continuously evolving, and...

CoronavirusRespiratory System

Coronavirus Impact on Indian Economy

3 Pages

1332 Words

Coronavirus disease 2019 (COVID-19) is an infectious disease caused by severe acute respiratory syndrome (SARS-CoV-2). It was first identified in December 2019 in Wuhan, China, and has since spread globally, resulting in an ongoing pandemic. As of 25th may 2020 around 5.4 million people are infected around 2.17 million people have recovered and the disease had caused around 3,45,000 deaths....

CoronavirusIndian Economy

Essay on Racism Against Asians in Canada Due to the Coronavirus

2 Pages

1043 Words

The article I chose for this essay is about the racism that is happening to Asian people in Canada due to the coronavirus. Amy Go who is the national president of the Chinese Canadian National Council for Social Justice in Toronto, explained that many of her friends and family have experienced xenophobia and racism due to the coronavirus. She spoke...

Coronavirus Crisis Impact on Micro and Macroeconomics

4 Pages

2022 Words

Coronavirus disease (COVID-19) is an infectious disease caused by a newly discovered coronavirus. This is a new virus that has been discovered in 2020 all around the world. During this virus has occur, there has been many economic impacts and has caused problems for example increase of unemployment and the banks reducing interest rates. Also, the main impact which is...

The Effect of Coronavirus on Companies in the Egyptian Stock Market

5 Pages

2135 Words

This paper aims to examine the effect of the spread of Covid-19 on the Egyptian companies trading in stock markets. The outcome of such an infectious disease is regarded as serious. It actually affected stock markets worldwide. Using an event study method, our results indicate that the stock markets in major affected countries and areas fell quickly after the spread...

CoronavirusStock Market

Reflection on My Spring Break during Coronavirus Pandemic

2 Pages

713 Words

All of this really started during spring break and we ended up having two full weeks of Spring Break. And ever since then all of our classes became online for the rest of the semester which has been a challenge to get used to at first. Now it has become easier to deal with. The entire time since the coronavirus...

The Positive and Negative Consequences of Coronavirus (COVID-19)

5 Pages

2079 Words

Abstract COVID-19 is an ailment triggered by a new coronavirus; this illness is known as 2019-nCoV and linked to the same family of Severe Acute Respiratory Syndrome. This disease has started in China on 31 December 2019 and then permeated globally. This paper is going to look at four aspects resulting from COVID-19 pandemic. The first one is the economic...

Coronavirus Disease Symptom Search Query Correlation with Confirmed Cases

4 Pages

1997 Words

Introduction Coronavirus disease (COVID-19), declared as an international pandemic by the World Health Organization is known for its a broad spectrum of symptoms that affect different individuals in a variety of ways that primarily range from inflicting mild sickness to severe illnesses [1]. The high and uncontrolled spread of COVID-19 is a source of major concern for the public, nevertheless,...

CoronavirusCorrelation

Starbucks: Expo 2021, PESTL Analysis and Coronavirus

2 Pages

972 Words

Starbucks is a famous café world wide you could find it almost everywhere in the world. Starbucks was founded in March 31, 1971 and was founded by 3 people named Gordon Bowker, Zev Siegl, and Jerry Baldwin. Most people love their coffee and usually like to start their mornings with a beverage from Starbucks. FACTORS OF PRODUCTION Starbucks need all...

CoronavirusStarbucks

Coronavirus Impact over the Tourism Reservations System

1 Page

528 Words

A reservation is a process of booking and blocking rooms, tables or, according to the Cambridge dictionary, an arrangement to have something kept for a person or for a special purpose in advance for the guests or tourists. When we refer to hotel rooms or a place arranged for the tourist to stay the right term we use is accommodations....

Impact of Coronavirus on Child Education

3 Pages

1565 Words

Abstract Online learning often means that the parents themselves are well educated to assist with the lessons and have enough time. Moreover, it will make it more burdensome for parents who are also affected by COVID-19 to provide equipment for online learning. Face-to-face learning will resume on 8 March 2021. All primary school students will resume the school term on...

Sharing Economy and the Coronavirus

4 Pages

1611 Words

Introduction The sharing economy becomes more relevant in the present context as the covid-19 pandemic triggers the factor to the full bloom. The idea behind the sharing economy differs from traditional business models. It is built around the sharing of resources. It involves mutual development, processing, delivery, trade, and usage by various individuals and organizations of goods and services. New...

CoronavirusImpact

The Luxury Industry during and after the Coronavirus Pandemic

4 Pages

2027 Words

The break-out of coronavirus pandemic has greatly impacted the whole world. People stayed at home during lockdown, or wearing masks all day during their work after the slightly alleviation. Not only the daily life has been changed dramatically, but also the business world. The most impacted business should be those who rely highly on world trade. The world trade in...

Is Coronavirus Pandemic an Act of God ?

3 Pages

1577 Words

What we are experiencing today is not unknown to anyone.The world is going through an unprecedented year, a year which no one dreamed or thought of.The disease outbreak i.e COVID 19 is travelling so fast and everyone is fighting the battle including superpowers who could not prevent people against it. This novel Coronavirus is spreading faster than fire all over...

CoronavirusGod

Starbucks and its Care for Employees during Coronavirus

2 Pages

733 Words

The World Health Organization (WHO) has declared that Coronavirus or COVID-19 is a pandemic which means that the virus has widespread over a whole country or the world. This problem not only affecting health of public but also has disrupted businesses and economies worldwide. Thus, the organization should play a big role in managing their human resource especially involving with...

CoronavirusStarbucks

Protecting Small Businesses from Coronavirus Effects

1 Page

572 Words

Coronavirus is an extremely contagious disease which has recently been declared pandemic. As a result, there are regulations imposing limitations on travel as well as sale and use of specified products, temporary restriction on the operation of institution, workplaces and bans on gathering and public events. The virus brings a host of legal issues for business. Most small business like...

Coronavirus

Impact of Coronavirus on Canadian Society

2 Pages

849 Words

Abstract Corona Virus is a respiratory illness that spreads from person to person. It is also known as Covid-19. Its symptoms are quite similar to a normal cold or flu. There is no vaccine available that can cure the Corona Virus. Due to the Coronavirus, there are some social issues taking place in Canadian society such as Racism or discrimination...

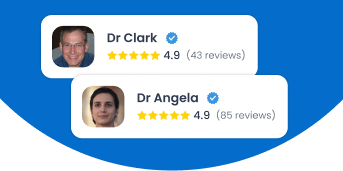

Join our 150k of happy users

- Get original paper written according to your instructions

- Save time for what matters most

Fair Use Policy

EduBirdie considers academic integrity to be the essential part of the learning process and does not support any violation of the academic standards. Should you have any questions regarding our Fair Use Policy or become aware of any violations, please do not hesitate to contact us via support@edubirdie.com.